Since then, they’ve been able to accumulate quite a user base, and they are considered one of the top European brokers. There are lots of them, so it doesn’t necessarily mean you’ve heard about them before. What is missing, however, are bonds and exchange traded funds , which were not offered by the broker at the time of writing.

The datapoints provided are used to calculate a rating based on what we beileve has the most benefit to their users. Desktop PlatformThe available versions of MetaTrader4 and MetaTrader5 are suited to various devices, including PC, Mac, Applications or Web platform that requires no installations. SO yet, you can download the desktop bdswiss forex broker review version for those platforms and use its full capability, which active or professional traders more need. Therefore, with access to the most liquid and famous markets, you may choose the desired and most understanding instrument according to your trading need and use BDSwiss user-friendly portal to benefit from trading.

Yes, BDSwissis authorized and regulated as an Investment Dealer by theFSCand it is authorized and regulated by the Financial Services Authority Seychelles. Overall, BDSwiss can be summarised as a safe broker that is fully regulated by the Financial Services Authority . BDSwiss is authorized and regulated as an Investment Dealer by the FSC and it is authorized and regulated by the Financial Services Authority Seychelles.

This BDSwiss review has been updated for 2022 by industry experts with years of financial experience in Forex, CFDs, & Social Trading. We have worked to gather hundreds of data points about BDSwiss to give you the most comprehensive guide available. You should log in to your Client Portal and submit a withdrawal request by following the required procedure. BDSwiss is an international brokerage firm established in 2012 in Zurich, which fastly approached Markets and became one of the largest trading groups. What do you need to know about trading and about the industry itself before you think about becoming a trader?

Company information

This makes BDSwiss a moderate risk forex broker for traders in South Africa as offshore & cross-border regulations are not as safer as domestic regulation & Tier-1 regulations. They are a reputed CFD broker that allows trading on a wide range of CFD trading instruments including 51 currency pairs & 200+ other CFDs on shares, commodities and indices. 1000+ Instruments including stocks and ETFs are offered on their platform. Corporate actions such as dividends and mergers will impact equity and index CFDs. One of the main drawbacks to trade with BDSwiss is an inactivity fee of 10% of the account balance (which will range from €25 to €49.90 or account currency equivalent) that will be charged after 90 days.

Also, BDSwiss offers excellent research tools and supports traders with unique materials, making you a better trader. Besides general and popular tools like Economic Calendars good quality market Analysis provided by the BDSwiss Analyst team, there is also access to Authochartist and Trading Alerts available to all clients. BDSwiss takes great pleasure in providing reliable trading conditions, with cutting-edge trading platforms and exceptional customer service. Commission-free trading and tight spreads also help traders to save on trading costs. Multiple educational and research resources like Autochartist and Trading Central can help beginners to learn and improve their trading skills. Yes, BDSwiss is a European forex broker that offers wide range of trading instruments & multiple account types to facilitate multiple types of traders.

A BDSwiss First Deposit Bonus is made available on the BDSwiss Premium Account. A minimum deposit of $100USD must be made for the 30% Deposit to be received. The BDSwiss signup bonus is structured as a +30% bonus program with a minimum deposit required of $100 USD. We are glad to hear that you are pleased with our Team https://forex-review.net/ and services Dimitri. We are happy to hear that all got sorted in the end and that you are pleased with our Team’s assistance. Our evaluation of BDSwiss reveals, that they’re a licensed Forex Broker providing the MT4 & MT5 software program, together with their very own customized web-based buying and selling platform.

BDSwiss FAQs

Trading with BDSwiss will involve fees from $2 USD, spreads from 0.3 pips to 1.5 pips, and commission-free trading depending on the account traders select. BDSwiss offers Islamic swap-free trading on selected trading account levels. BDSwiss offers Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries. Users can trade through computer device on well-known trade terminals as Metatrader 4 and Metatrader 5. And there was an extra application for iOS and Android developed by the broker for mobile trading. It has advanced functional features and you can open and close deals with one click.

The incurred charges at BDSwiss differ for the account type chosen by the trader. Proprietary BDSwiss WebTrader is fully based online, so you don’t need any downloads or installation and may access trading right from your browser. The platform has a clean view and quite comprehensive and powerful analysis features including technical analysis and risk management tools. So even by the use of WebTrader you can make full out of trading, see trading snapshot below.

The leverage of BDSwiss

The technology embraced by BDSwiss is among the maximum caliber, making sure that it is fast, dependable, and efficient. MT5, a newer version, also gained great popularity and featured even more advanced tools and comprehensive analysis options, loved by beginners or professionals. Moreover, there are plenty of strategies to choose from that are helpful for every trader, novice or experienced, either with manual trading or automated trading through EAs. You can trade it all as you would normally or take a risky and potentially more profitable route through CFDs . On BDSwiss, they are just part of the usual routine and you’re welcome to try it.

As the broker mentions it always aims to give withdrawal service within 24 hours, yet this is applicable towards working business days, as on weekends or holidays it may take longer to proceed. As well, always give additional days for your payment to proceed with the transaction once it is already confirmed and done by BDSwiss, while we got withdrawal pretty quickly. Overall, BDSwiss can be summarised as a safe broker that provides competitive spreads and a low no-activity fee. BDSwiss has an average monthly trading volume of $84 Billion which earned them a trust score of 94 out of 100.

These are not trading tutorials but lessons and articles about the industry as a whole. The approach is the same as with MT4, but given that the newer version also supports more exquisite and generally more effective tools, they were able to implement advanced mechanisms. They couldn’t do otherwise, these are the flagman interfaces used by the majority of FX and CFD traders. And there is also BDS’s own software in several variations, but let’s first discuss what they did with MTs.

If trading currency pairs is of interest to you then BDSwiss offer over forex pairs. This BDSwiss review breaks down each of the relevant non-trading fees for you in detail. This BDSwiss review page contains information about investing with BDSwiss. It is intended for educational purposes only and should never be considered financial advice. We do not recommend or advise that investors buy or sell securities or stocks. BDSwiss is a reputable trading partner that was founded in 1994.

- As of 2019, the company is home to 1.3 million accounts, with over 30 billion in average monthly forex volume.

- For the demo account, you need to register and contact your account manager in order to have demo funds added to your accounts.

- Customer support is a service that a trader requires daily, available on a very sustainable and professional level here, and has been successful in answering customers’ complaints.

- Getting into the area of trading online requires expert assessing skills and thorough knowledge.

- Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing.

You might also start positions, test different trading approaches, and much more. In the event you’re withdrawing money in various currencies from USD, a conversion fee is also important. The conversion fee will depend on the money you are opting to withdraw in.

BDSwiss has more than 1.5 million clients from over 186 countries and serves as an exclusive Member club with more than 1.5 million traders. Inactivity is when the client has not opened or closed trade and has not made any transactions. The fee is a minimum of 25 € and a maximum of 49.90 € high (10% of the account balance). In summary, the fees are manageable and not significant to most traders. Finally, we should take a closer look at the fees and costs at BDSwiss.As you have read in the previous sections, spreads may fluctuate depending on your asset and market conditions. These are the trading fees whereby the broker earns his money.

BDSwiss Mobile App

From my experience, the app works just as well as the online platform or Metatrader 4/5. You will find all the necessary functions very quickly and get the fastest access to the markets. The trading fees are depending on the account type or asset. If you deposit more or have a high trading volume BDSwiss can provide you with better trading conditions.

For example, the typical spread for EUR/USD is 1.1 pips (compared to 1.5 pips with Classic account). If you are not looking to trade CFDs on indices, and only want to trade Currency & Commodity CFDs, then this account is okay. You also can have a ZAR currency account on a Premium account and the deposit will be 150 ZAR.

LBinary Review (

BDSwiss has a lot to offer, but the experience is deeply flawed, and there are certainly better candidates. Whether they are particularly bad at their job, it remains to be seen. Comparebrokers.co needs to review the security of your connection before proceeding.

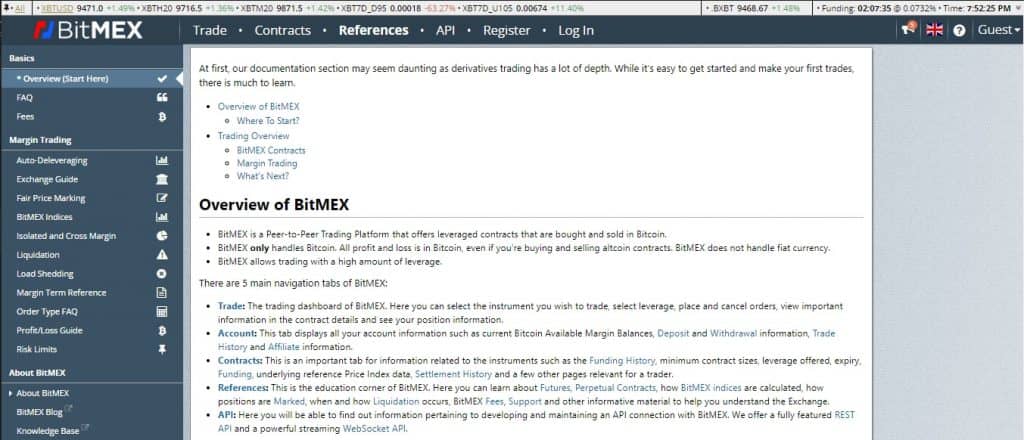

The BDSwiss WebTrader does not need to be downloaded and is completely synchronised with the downloadable versions of the MT4, allowing for live price monitoring via a sophisticated market watch window. The WebTrader, which is available in over 20 languages, is intended to meet the needs of traders all around the world. It is designed to provide you full control, allows you to access your account quickly and effectively on any device. The BDSwiss’ MT5 trading platform is very similar to MT4 but offers more features to further enhance your trading possibilites. Traders have numerous deposit options from which to choose. Besides traditional bank wires and credit/debit cards, supported payment processors include Skrill, Neteller, PayPay, giropay, Sofort, eps, iDeal, and dotpay.

Forex pairs, cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money. TopBrokers.com would like to remind you that the data contained in this website is not necessarily real-time nor accurate. In addition, the company runs an active blog and community of traders, which allows sharing the experience to get better knowledge about the markets and trading itself.

By maintaining optimum support and assistance, refined products and full transparency, the BDSwiss also educates its clients through its Academy. Educational resources covering helpful information on operating in markets develop own trading strategy with accredited courses and webinars. BDSwiss provides access to seamless trading through the fantastic range of 250+ underlying assets, while you may choose from leading Indices, Forex, Commodities and Cryptocurrencies based on CFDs. Leverage, a loan is given by the broker to the trader, enables you to trade through the multiplied volume that may raise your potential gains, yet in reverse, increases high risks. Also, various regulatory standards and restrictions set a particular allowed level of leverage that is considered safe. Even the mobile app has issues with money withdrawing – otherwise it’s perfectly comfortable.